In recent years, money transfer apps have become incredibly popular and are used by millions of people every day. They are used for everything from splitting the restaurant bill with a friend, sending birthday money to relatives, paying for odd jobs, and even purchasing items from local sellers. But along with this convenience comes some danger.

Cash App has made it fast and easy to send money to someone instantly. However, not everyone who uses Cash App is going to be honest and fair. To protect yourself, you need to understand how these scams work, the types of threats that are out there, and how to report abuse and protect yourself.

What is Cash App?

Some of the most popular cash apps used by consumers include Apple Pay, Venmo, PayPal, Zelle, and Cash App. These apps connect directly to your bank account and deposit or remove funds as you use them. Most of them are free, but some charge a small amount to use their service.

Don’t let malware steal from your CashApp

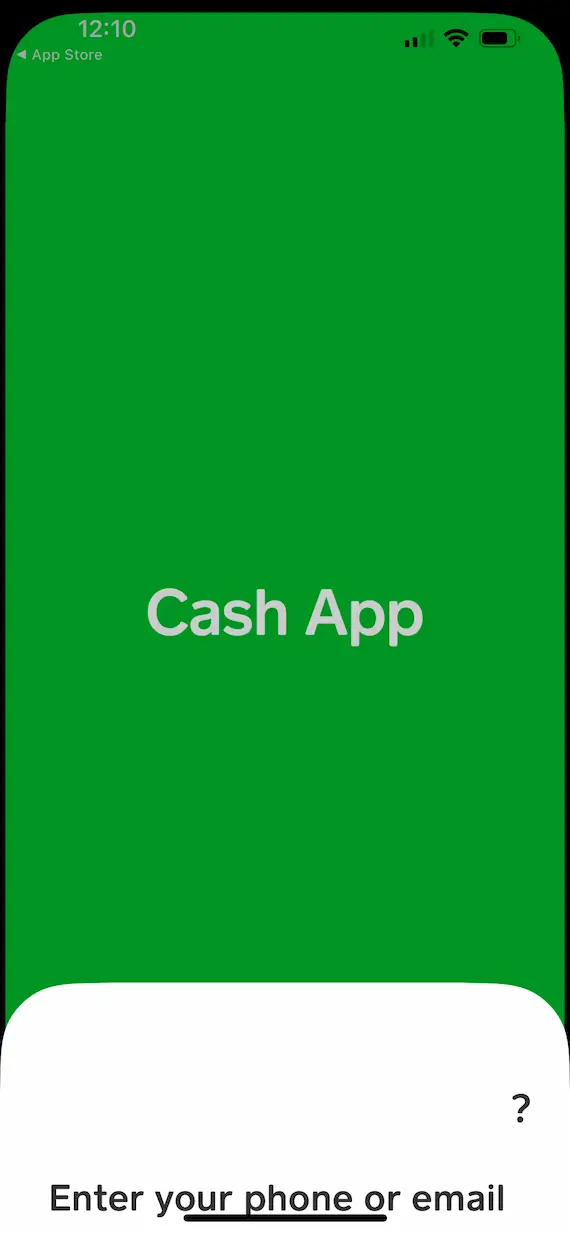

Cash App is a peer-to-peer payment system where you can instantly send cash to another person. The app offers additional services allowing you to invest in stocks or buy bitcoin directly through the app.

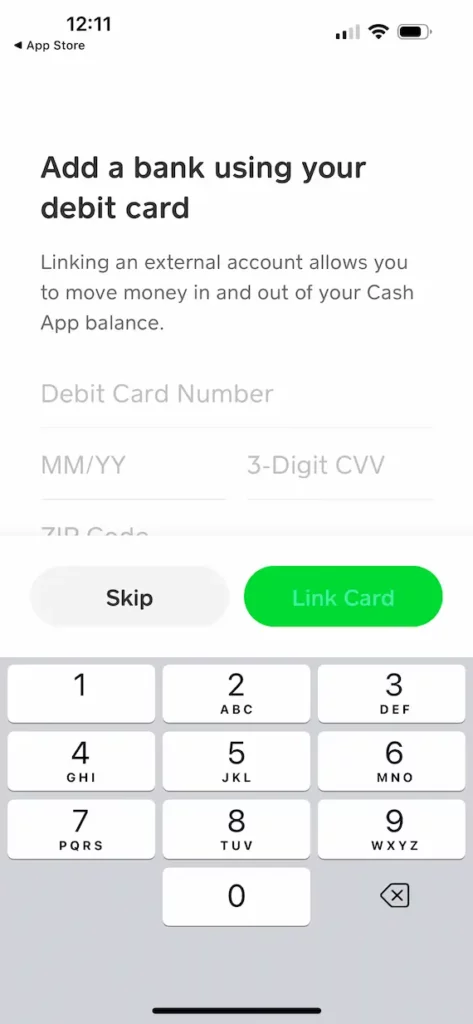

To start using Cash App, all you need to do is set up a free account. You can sign up using your email address or phone number. Right away, it requires you to connect your bank account using a debit card. You then set up a unique username called a $Cashtag. You can even order a real plastic card to go with your account.

What you should you know about Cash App scams

Unfortunately, along with amazing digital tools like Cash App come plenty of scams to worry about. Clever cybercriminals have devised many different ways to scam users out of their money. Some of these scams may be surprising because they are easy to fall for if you don’t know how to protect yourself.

How does a Cash App scam work?

Typically, a scammer will contact you in various ways and ask for your personal information (social security number, license, ID, login, etc.) or try to get you to transfer cash to them.

Types of Cash App scams

There are dozens of Cash App scams. Some of these include the Cash App Bitcoin scam refund, the Cash App scam on Facebook, and Instagram Cash App scams. The 8 most popular Cash App scams are detailed below.

1. Cash App money flipping scam

One of the more popular scams on Cash App is the money-flipping scam, which works like a pyramid scheme. Victims are contacted through social media, SMS, or email and asked to invest in stocks, promising a quick payoff. They are told to send cash, with the promise of their investment being tripled within just a few days. The problem is, if you do send money, you’ll never hear from them again.

2. Accidental transactions

Another way scammers con victims out of their money is to trick them by using accidental transfers. In this scam, you will unexpectedly receive a message claiming that someone sent you money by mistake and asking you to send it back to their bank account. You may even receive money in your Cash App account that you didn’t expect. The scammer will then request it back. However, they will then reverse the transaction, causing you to lose that amount from your account plus the payback. Never respond if someone sends you money by mistake. Instead, contact Cash App for support.

3. Pretending to be customer support

Many of us have heard of scammers calling and pretending to work for Apple or Microsoft to gain access to our accounts. The Cash App scam works similarly in that someone will contact you via SMS, email, or phone and pretend to work for Cash App. They may ask for your $Cashtag and password. Once they have your account credentials, they can drain your account. Be wary if someone claims to be from customer support and wants to help you out of the blue.

4. Cash App glitch scam

Another underhanded scam is when fraudsters contact you with the claim that there is a glitch in the Cash App system and you need to download a new version. But, instead of having you download from the Play Store or App Store, they send you to a malicious website. When you subsequently enter your credentials to download the phony app, the scammers can gain control of your account.

5. Cash App scams with refund

Similar to the accidental transaction scam mentioned above, another type of scam involves bad actors contacting you after you purchase a product online. They will then offer you a refund for the product if you simply agree to pay a small fee — you don’t even have to return the item! Of course, it’s all a scam. If you pay the fee, you’ll never see that money or your refund again.

6. Cash App scam email

Many Cash App scams begin with fraudulent emails. Phishing emails often impersonate someone of authority like your bank, a credit card company, or perhaps your boss. These emails will sound urgent, usually demanding that you send money quickly through the Cash App. But if you do, that money will be gone forever.

7. Screenshot fraud

Another ridiculous scam perpetrated by cybercriminals involves sending you a screenshot confirming an amount that they claim to have sent you. They will then request it back, saying that they sent you the wrong amount and need to correct it. Other times, they may tell you that you won a prize or that an investment you made paid off big. Either way, never send money through the Cash App to anyone you don’t know.

8. Schemes with crypto

Cryptocurrency scams are nothing new, but threat actors are now using the Cash App platform to lure you to “invest” in fake moneymaking schemes. If you send money to these scammers to purchase crypto, you’ll never see any returns. Cryptocurrency is anonymous, untraceable, and nearly impossible to recover. Only purchase crypto through verified platforms, never through a third party.

How to report a scam on Cash App

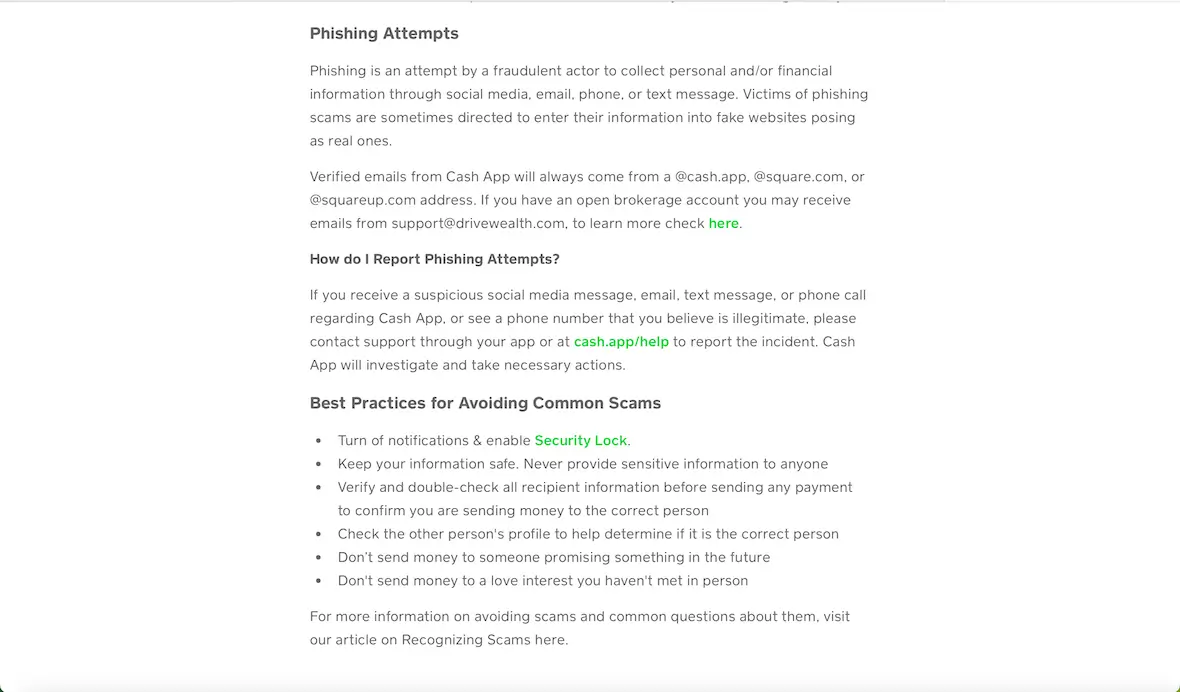

If you experience one of these scams, report it to Cash App immediately. You can contact the legitimate customer support team through the app or by visiting cash.app/help.

How to avoid Cash App scams

The best way to avoid Cash App scams is to follow the tips below to avoid being scammed out of your hard-earned money:

- Never click links in email or SMS messages, especially if you don’t know who they came from.

- Don’t send money to anyone you do not know, even if they say they accidentally sent you money or show you a screenshot. These things can easily be faked.

- Never enter your credentials online unless you visit the website directly.

- Always verify the legitimacy of a website (check for the lock and the URL).

- Enable Security Lock within the app.

- Never share your login credentials with anyone.

- Never trust anyone claiming to be from customer support unless you contact them.

The bottom line is if something sounds too good to be true, it probably is. And if someone promises you free money for doing practically nothing, it’s certainly a scam. Do yourself a favor and just walk away.