Venmo is one of the most popular payment apps used to send and receive money for personal and business transactions alike. As with any financial platform, however, hackers use it to commit fraud and target users for Venmo scams.

Keep reading to learn what a Venmo scam is, how it works, and the most popular scams. You’ll also discover how to spot scams and how to keep your money safe.

Worried about digital safety?

What is a Venmo scam?

Cybercriminals use various techniques to scam people out of money. They use social engineering to trick victims into initiating payments through Venmo. A Venmo scam is one that uses the Venmo payment platform to commit fraud.

Is Venmo safe?

Venmo is a perfectly safe way to send and receive money if you only do so with people you know. It is not safe to send money to strangers via Venmo, as you cannot reverse transactions. This means that if you get scammed, Venmo may not help you.

How does a Venmo scam work?

Venmo scams come in many forms and work differently. However, the main goal is to get you to send money to scammers. Attackers use phishing emails, text messages, and calls, or they may even connect with you on social media to attempt to trick you into sending money via Venmo because they know you won’t be able to get it back.

Types of Venmo scams

Cyber thieves are clever creatures who have dreamed up many different types of scams to steal money. Some of the most common Venmo scams work as follows.

Venmo business account scams

One way scammers use Venmo to get money is to send you an email claiming that your account is limited and you can’t send or receive money. You need to upgrade to a business account for a one-time fee (an amount around $250 or however much the scammer thinks they can get). They instruct you to pay the amount via Venmo, and you’ll be all set. The problem is that the entire thing is fake, and any money you send goes to a scammer.

Facebook Marketplace Venmo scams

Facebook Marketplace is an online shopping mecca frequented by millions of users. For scammers, it’s also full of targets ripe for the picking. In one common scam, the scammer posts a product on Facebook Marketplace, and when you message them to ask about it, they instruct you to pay in advance via Venmo. If you pay before picking up the product, however, you’ll never see it. In many cases, the ad was fake from the start.

Venmo scam call

It is rare that Venmo contacts its users, so if you receive a call with the caller ID listed as Venmo, it is probably a scam. Bad actors can spoof phone numbers, making it look like they come from legitimate sources. They may claim to be from customer support, alerting you that your account is in danger of being hacked and that you need to provide your login information right away so they can fix it. Their real motive is to steal and use your information so they can drain your funds.

“Accidental” transfer fraud

Venmo payment scams begin when a hacker steals a credit card number and then sends you money via Venmo. They then contact you to say that they “accidentally” sent it and request that you refund it. The payment appears to be in your account, so you send the money as requested. Then the credit card company reverses the transaction because the card is flagged as stolen, and that money disappears from your account.

Venmo email scams

Email is the most popular method of communication in the digital age. Hackers frequently use a Venmo phishing scam, also known as a Venmo email scam, in which they send you an urgent email claiming that there is a problem with your account that you must fix immediately.

The sender may ask you to update your payment information or verify your credentials. If you click the link, you may be taken to a fake website where any information you enter is stolen, or your device could be infected with malware.

Venmo scam text messages pretending to be tech support

Another troubling scam involves text messages sent from attackers claiming to be from Venmo’s tech support department. They will ask for account details and passwords for supposedly legitimate reasons. But once you give your credentials, the scammer can access your account and transfer money to themselves.

Paper check fraud

The paper check fraud scam is an old one since most people don’t pay using checks anymore, but it still happens. The scammer sends you a check in exchange for a purchase or a service, but the check amount is for more than you requested. Claiming the discrepancy was an error, they will ask you to refund the difference via Venmo. Once you do, the check bounces, and they keep the “refund.”

Fake prizes

In this scam, you receive an email or text message claiming that you’ve won a prize. All you have to do is pay for shipping or other fees via Venmo, and it will be delivered to your door. Don’t fall for it. There is no prize.

Romance scams

One of the most heinous scams revolves around romance. A hacker will initiate an online relationship with someone by sending frequent texts, getting them to trust them and, eventually, enter into a romantic relationship. Once the attacker knows the victim is on the hook, they set the trap and ask for money via Venmo for a medical emergency or urgent trip.

Overpayment scam

Venmo payment scams are a dime a dozen. These works very much like the paper check scam: Someone overpays you and then demands that you refund the difference via Venmo. Once you do, the original payment is refunded, if any payment even occurred in the first place.

Does Venmo protect against scams?

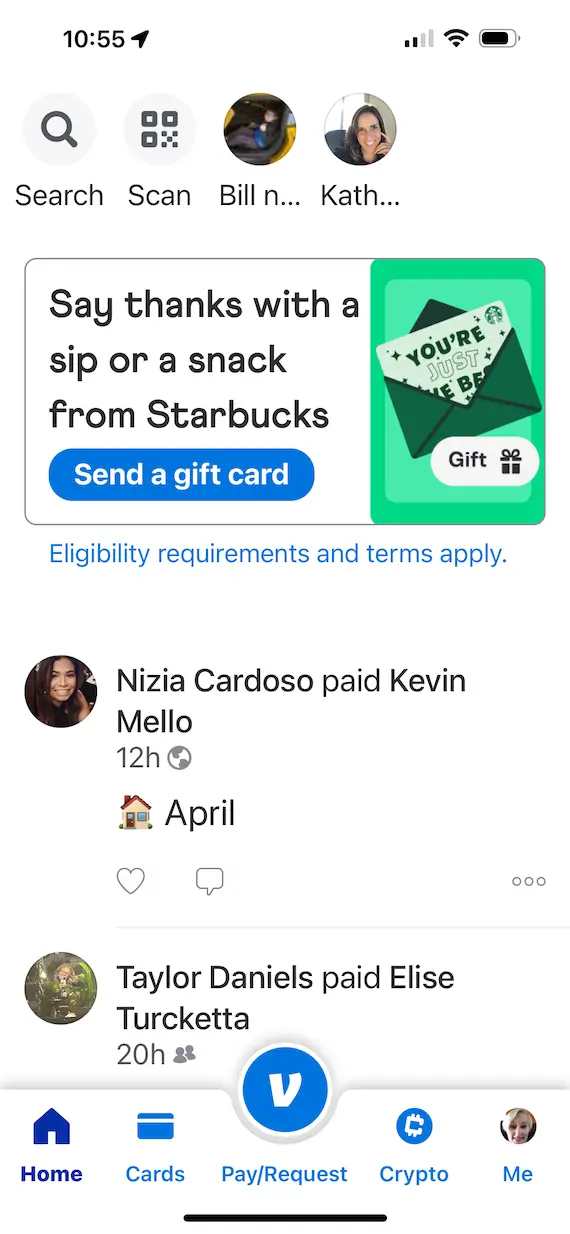

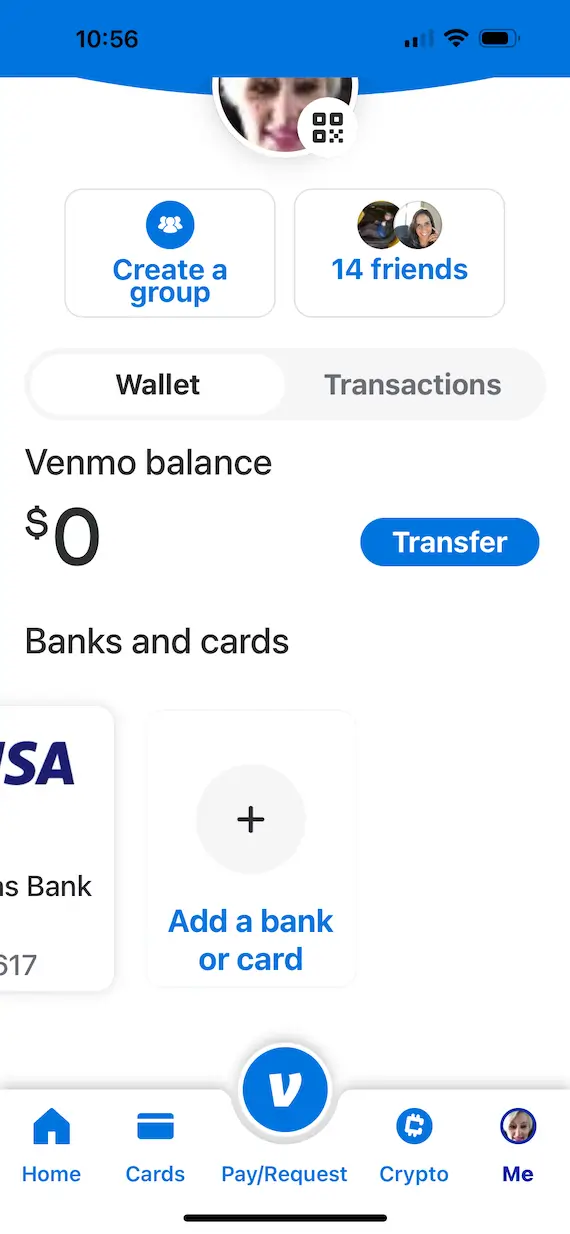

The Venmo app is fully encrypted to keep prying eyes out. That said, it’s largely up to you to protect yourself when using payment platforms.

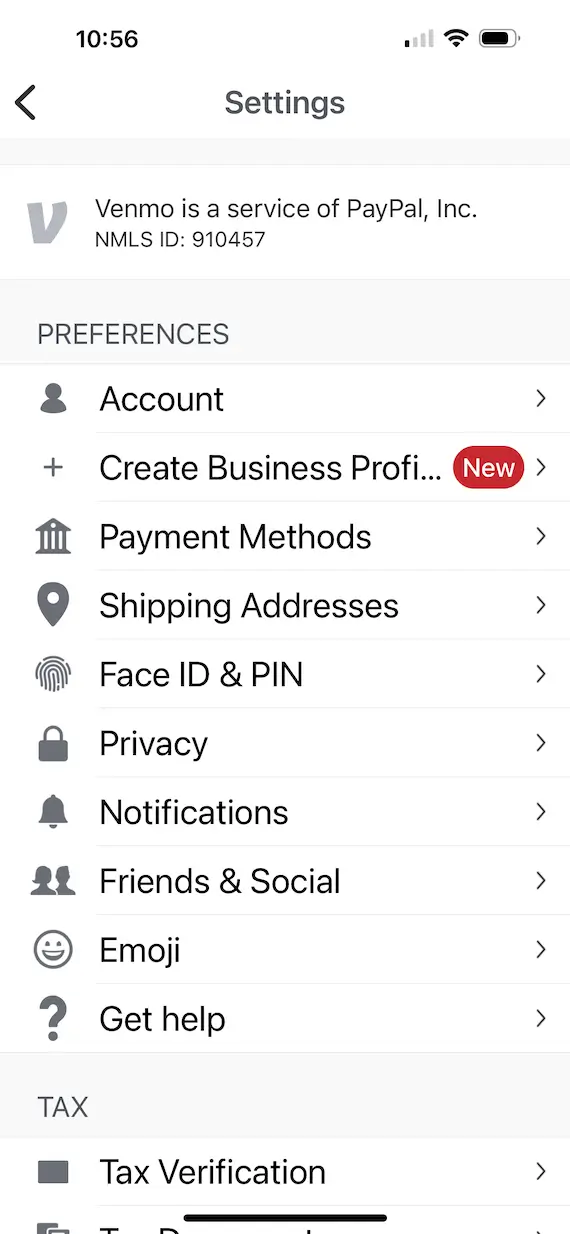

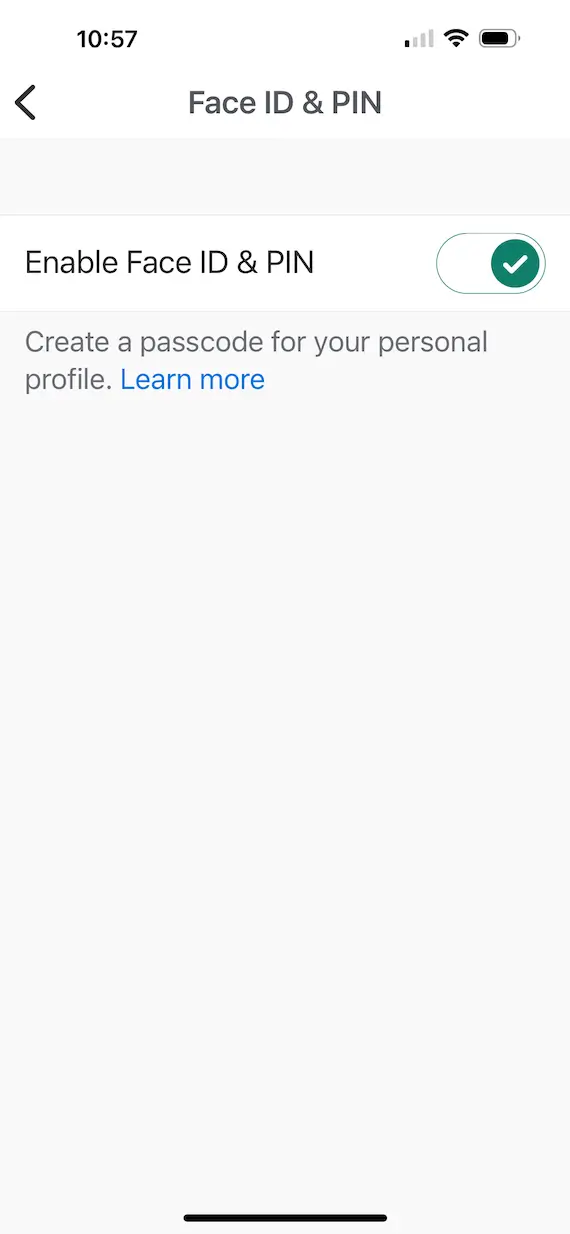

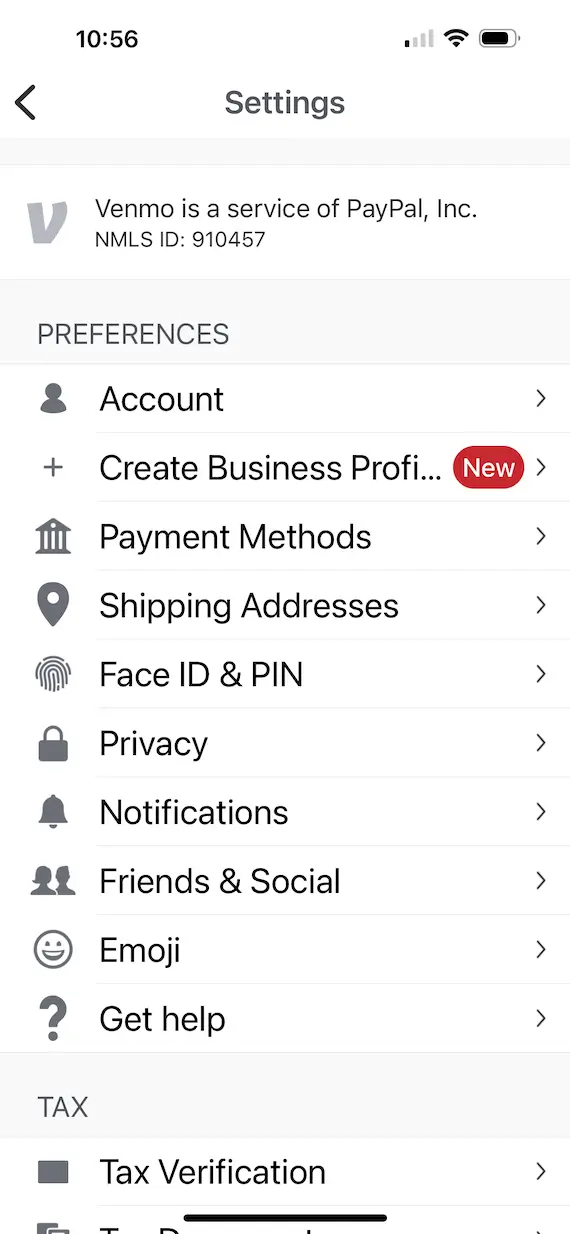

Thankfully, Venmo does include some security features like enabling Face ID and PIN codes to lock others out of the app. You can also turn on 2-factor authentication on your account to ensure that no one uses your account other than you.

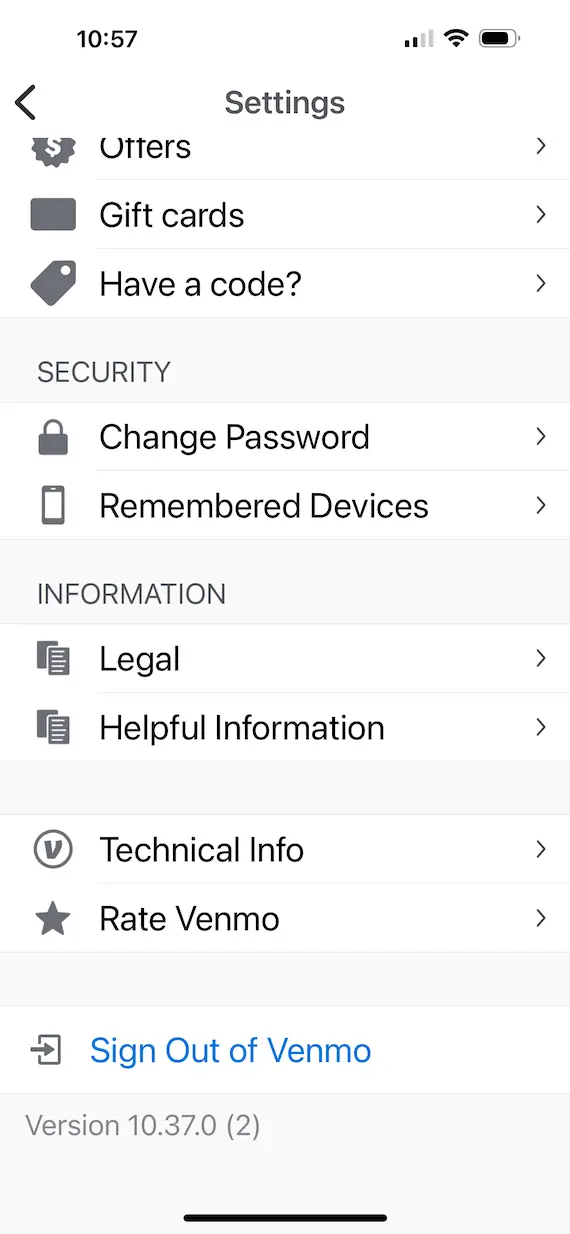

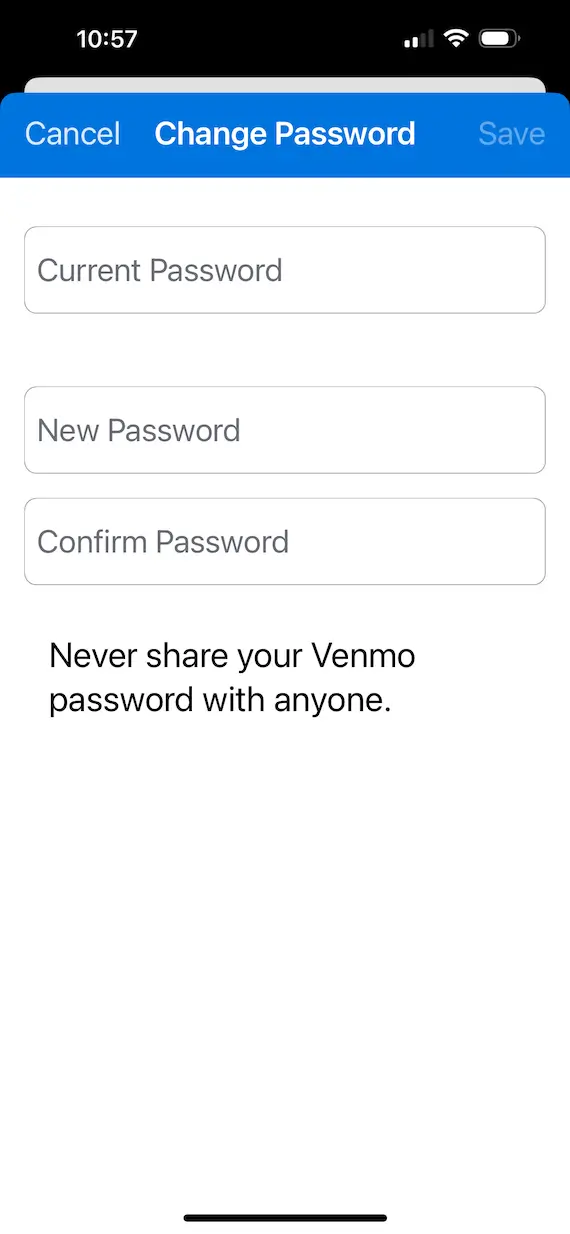

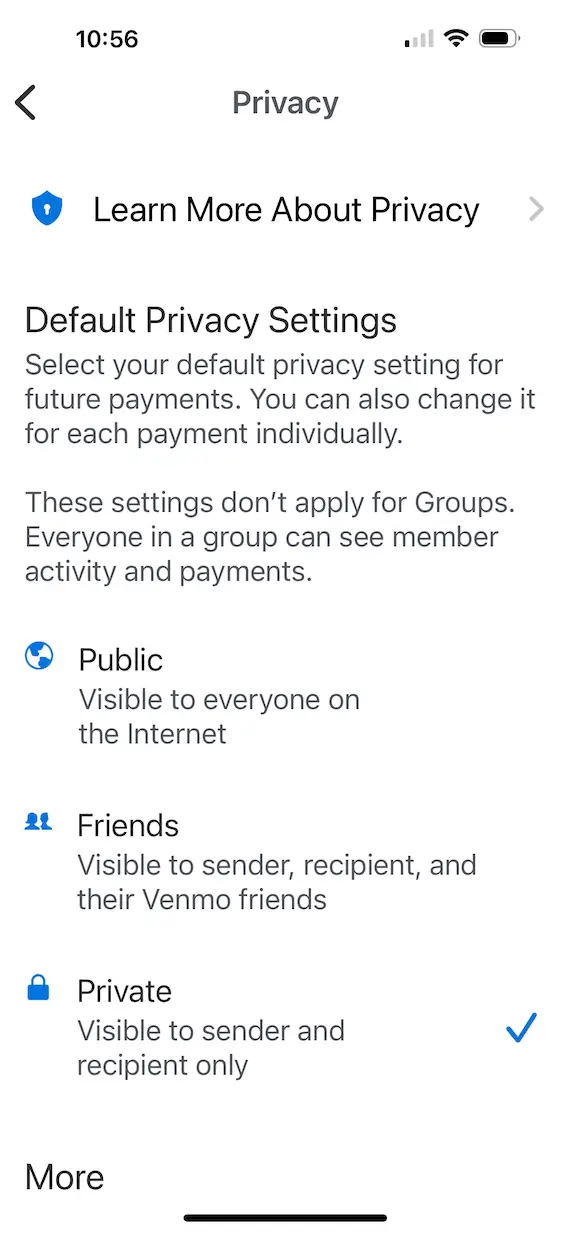

Another option is to turn on private mode, so only your friends and connections will see your account. You can change your password easily from inside the app anytime if you suspect fraud.

Does Venmo refund after being scammed?

No. Once you send money via Venmo, you will only get it back if the person who received it refunds it to you.

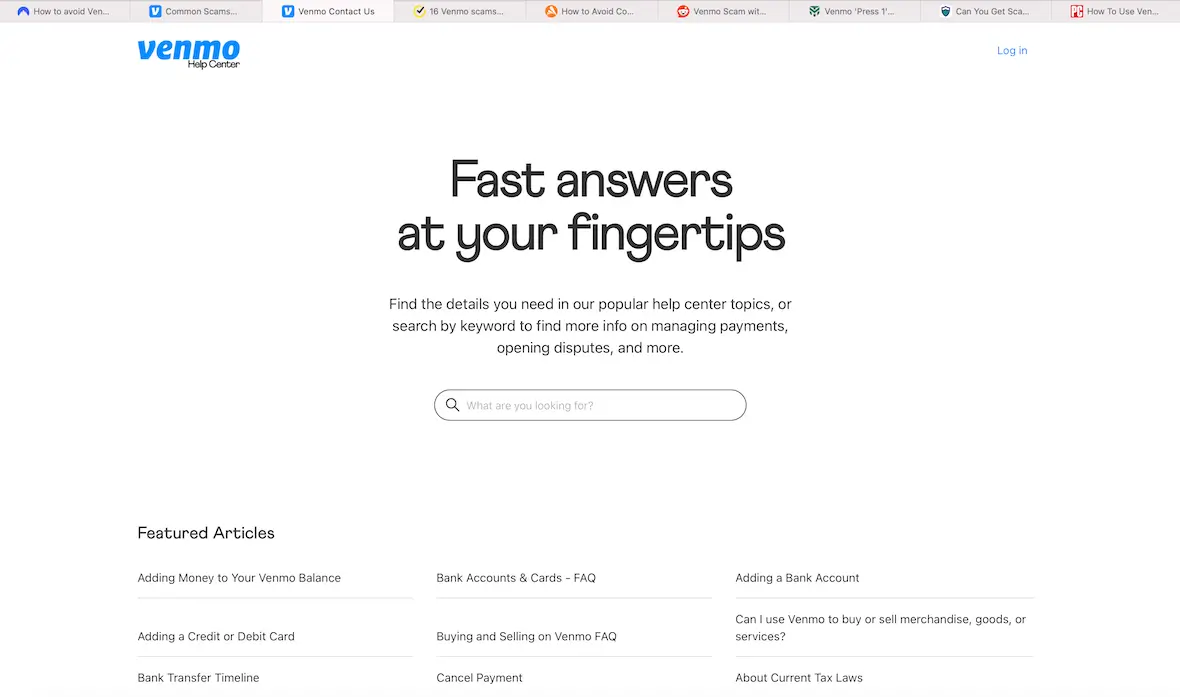

How to report a Venmo scam

You can report a Venmo scam by contacting Venmo’s Help Center and choosing the option to report the fraud.

How to spot a Venmo fraud

Spotting a Venmo scam is easier than you might think. Hackers are crafty, but they are also predictable and follow similar patterns. Use the signs below to identify a scam and stay safe.

A stranger contacting you

If a stranger contacts you out of the blue by email, text, or social media, be wary, especially if they claim to be from Venmo. Venmo rarely contacts anyone and never asks for personal information.

A sense of urgency

Scammers try to elicit a sense of panic to get you to act quickly without thinking. The message or call will always contain a sense of urgency in an attempt to scare you, so you send money or provide information before realizing it’s a scam.

Spelling and grammatical errors

It’s uncommon for legitimate messages from major companies or organizations to contain errors in spelling or grammar, but scammers’ communications are often riddled with errors.

Asking for personal information or money

A scam always has a goal. Usually, it is to obtain personal information (login credentials, bank account information, credit card numbers, etc.) or money from you. If someone asks for something, let that be a big red flag.

How can you prevent Venmo scams?

An ounce of prevention is worth a pound of cure. You can avoid getting scammed by staying alert and using the following tips.

Enable 2FA

Turn on 2-factor authentication (2FA) to add an extra layer of security to your account. Fingerprint ID, Face ID, or PIN codes are also valuable ways to protect your device and prevent others from using it without your permission.

Never send money to strangers

If someone requests money through Venmo, think hard before sending it. Unless you know a person well, you could be falling prey to a scam. Do not give out personal information, either.

Set Venmo privacy settings

In the Venmo app, turn on maximum security and privacy settings, including Face ID and PIN security.

Never let a stronger borrow your phone

Strangers who ask to borrow your phone may be scammers looking to access your Venmo account to steal funds quickly. Protect your phone at all costs.

Using common sense can help you avoid many scams, including those that use the Venmo payment app to commit fraud. Always be on the lookout for suspicious emails, texts, links, and phone calls.

This is an independent publication, and it has not been authorized, sponsored, or otherwise approved by PayPal, Inc. Venmo is a trademark of PayPal, Inc.