Scams of all kinds abound in the digital age, but those that target financial tools are particularly worrisome. If you aren’t careful, you could end up losing money or even access to your bank accounts. Using payment apps like Zelle has become second nature to many of us, but there is always the potential for danger when you link a third-party app to your bank account.

A few common scams use Zelle to steal money and information. Keep reading to learn all about Zelle scams, the most common types, how to spot and report them, and how to stay safe.

Use Zelle on desktop safely

Are there any Zelle scams, and how do they work?

Zelle is a peer-to-peer payment app that allows you to send and receive money easily. Unfortunately, some scammers use Zelle in their schemes because it is linked directly to users’ bank accounts. This means that if a cybercriminal gains access to your Zelle information, they could drain your bank account of funds.

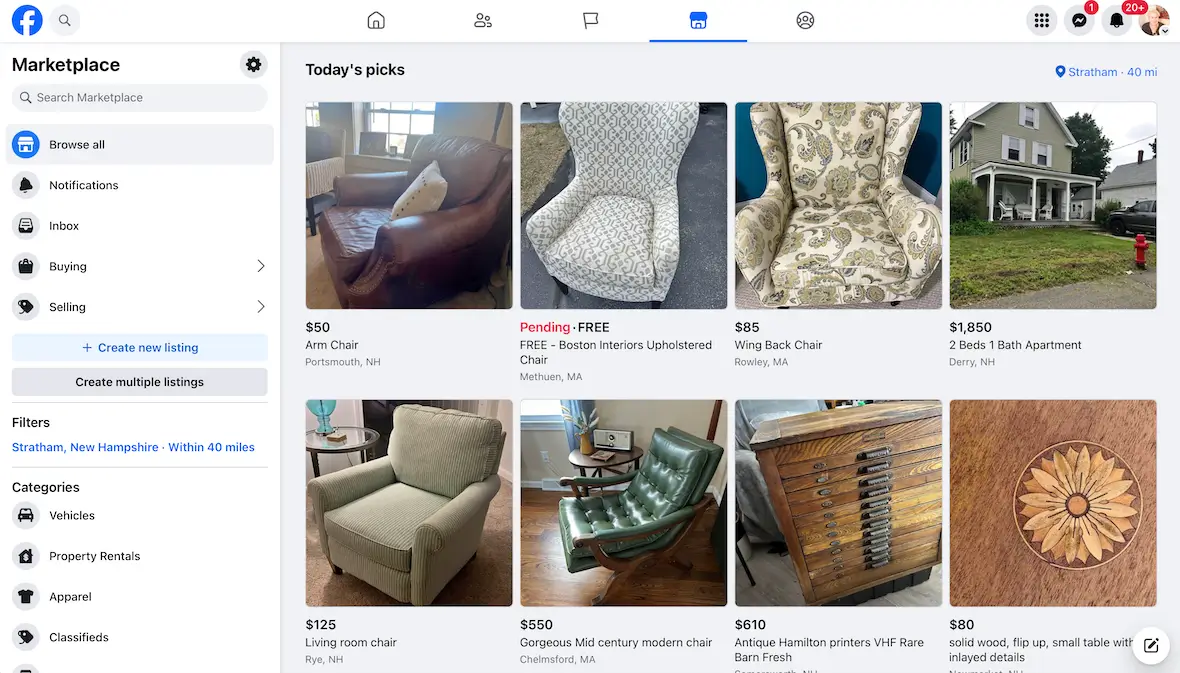

Alternatively, a scammer may use social engineering, such as phishing, to trick victims into trusting them, and then they ask for money through Zelle. Or they may use Facebook Marketplace in their ruse. You can be scammed in a variety of ways.

Will Zelle refund money if you get scammed?

The answer to this question used to be no. But in 2023, Zelle began to review cases individually, in some cases refunding people’s money when they were victims of scams. Whether or not you’ll get your money back depends on your bank’s policy and a few other factors. You must file a report with Zelle and your bank to report the fraud.

The 7 most recent Zelle scams

Bad actors have a wide array of ways to scam people out of their hard-earned money. We have rounded up 7 of the most recent Zelle scams going around so you can stay safe and be on alert.

1. Zelle business account scam

The Zelle business account scam targets sellers online who are offering big-ticket items. The fraudster pretends to be a buyer and says they will pay for the item via Zelle. They will then claim to have paid, but the seller needs to upgrade their account to a Zelle business account before they can access the funds. They will then provide helpful instructions on where to send the funds. When the victim sends the money, however, it’s the scammer who is the recipient. That money is lost, and they’ll likely never hear from the would-be buyer again.

2. Facebook Marketplace Zelle scam

Similarly, the Facebook Marketplace scam targets sellers on the popular shopping site. The scammer asks if your item for sale is still available (very soon after it’s listed). They then ask for your email address and phone number. You will soon receive a phishing email with fake information regarding the sale, and somewhere, they will ask you to click a link that infects your device or requests that you pay some sort of fee via Zelle to make the sale.

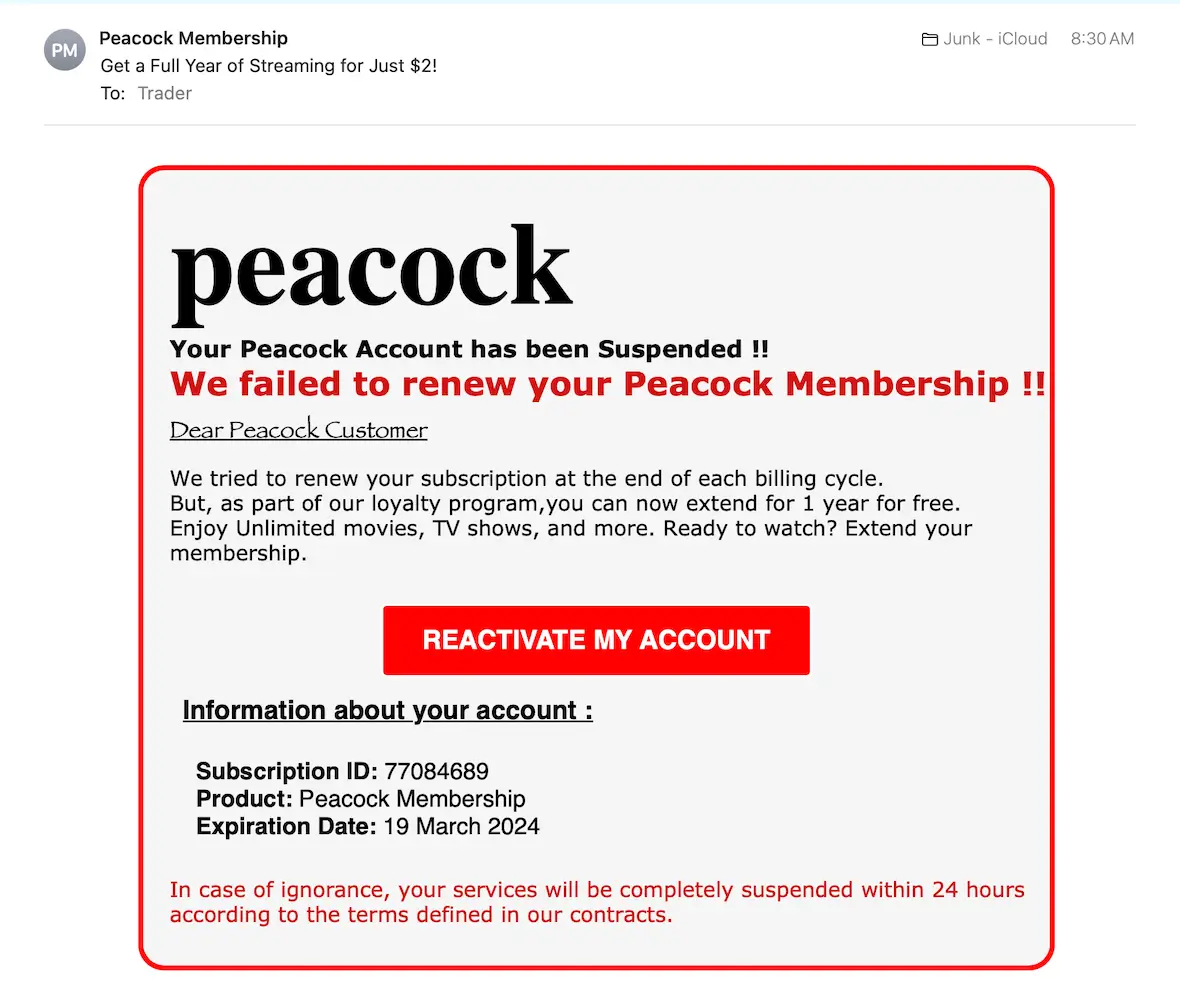

3. Phishing email scam

A common scam is for scammers to send legitimate-looking emails claiming that a service has been canceled. The email will insist that you must click on a link to pay via Zelle in order to renew your membership. Of course, a legitimate company will not ask you to pay for your renewal specifically via Zelle, and any payment you make will go directly to a scammer.

4. “Pay yourself” Zelle scam

Hackers steal all kinds of personal information to use to defraud you. Sometimes, they spoof your caller ID and Zelle account in order to take over. In one common scam, a scammer will call you and claim that there is a problem with your account, and you need to “transfer” money to yourself to fix it via a link they provide. This is a red flag. Do not fall for it. The funds you “pay yourself” will, in reality, go to the scammer, not your account.

5. Account takeover

If a cybercriminal can access your Zelle account, they may also be able to get control of your bank account. Never give out any sensitive personal information to anyone who asks for it via email, text, or phone. This could be used to gain access to your Zelle account. Once they have access to your account, they can change the password and lock you out!

6. Refund scam

Refund scams often target victims who have recently been defrauded. You may receive a call out of the blue from someone claiming to be from your bank or Zelle. They may refer to a recent payment scam and explain that you are due a refund. This sounds like good news at first. But they will then attempt to talk you through a confusing process that will, in effect, have you paying them instead of them refunding you.

7. Zelle screenshot scam

Zelle app scams cover a lot of ground. One relatively simple way they trick people is to claim that they sent money via Zelle (for a purchase or service). They will even send you a screenshot to “prove” it, only to then request that you send them a full or partial refund. They may claim to have paid you by mistake and ask that you return the funds. In reality, the screenshot is fake. They never sent you any money. Any “refund” you give, therefore, is simply a payment made straight to the scammer.

How to spot Zelle scams

As always, the best way to avoid Zelle fraud is to know what to look for and take thoughtful action. Some of the red flags to watch out for with any scam, especially financially motivated ones, are:

- A sense of urgency and pressure for you to take action

- Requests for personal information like login username, password, or bank details

- An offer to help fix a problem you didn’t know existed in the first place (and probably doesn’t)

- Poor grammar, spelling mistakes, or odd phrasing

- Demands to pay via Zelle when it makes no sense to do so

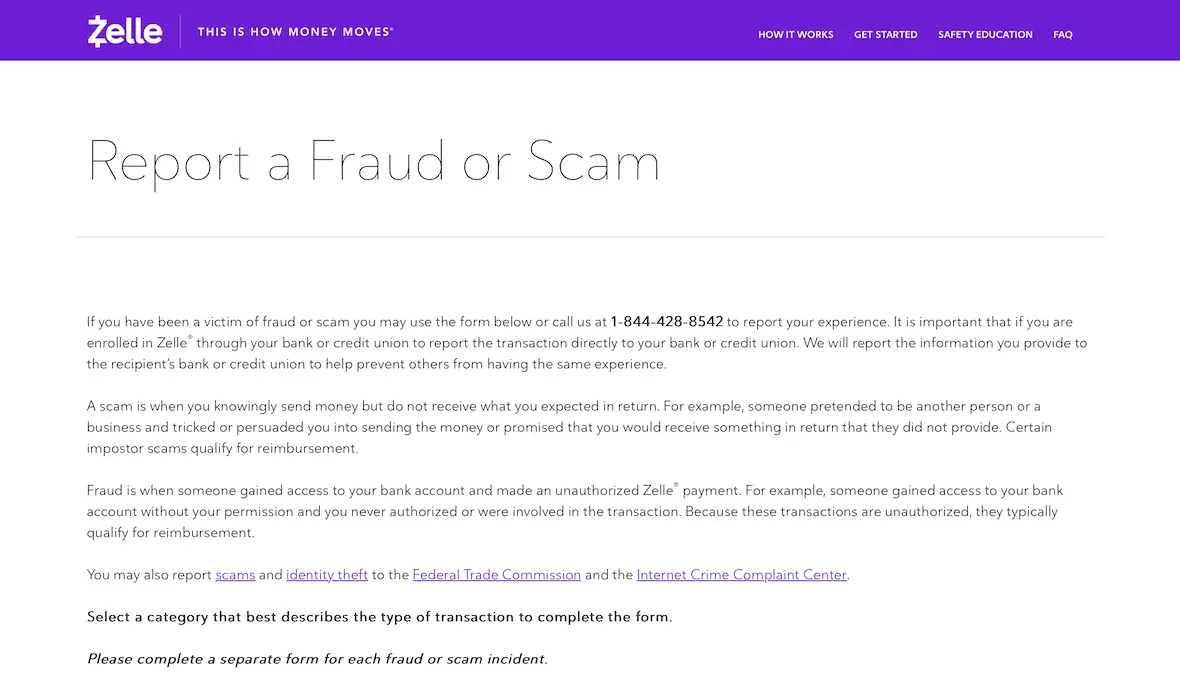

How can you report a Zelle scam?

Zelle has a page with instructions on how to report a scam. You can complete their online form or call 1-844-428-8542 to report your experience. There is no guarantee you will get your money back by reporting the problem, but you should do so anyway. Also, report the theft to your bank.

Guarding yourself against Zelle fraud

Although the world is full of scammers itching to take your money, you can take steps to safeguard your accounts and your funds. Use the following tips to stay safe.

Watch out for social engineering

When a stranger contacts you online, be wary. They may show signs of trying to quickly gain your trust. Then they ask for money. Always be on the lookout for this type of fraud.

Set up 2FA or MFA

To keep your bank account and Zelle account safe, always opt in for 2-factor authentication (2FA) or multi-factor authentication (MFA). In general, you should turn on as many safety features as you can.

Don’t trust unsolicited emails

Never automatically trust an email. Even if the email you receive looks legitimate, don’t click any links. Instead, visit the website manually, log on, and search for information that way. Verify all information before taking action.

Regularly check your credit reports

Always check your bank account, credit card, and credit reports for suspicious activity or signs of fraud. You are entitled to a free copy of your credit report each year.

Zelle is a helpful tool that’s perfectly safe to use to pay family and friends. Be on alert, however, when someone you don’t know asks you to pay using Zelle, as it could be a trick.

This is an independent publication, and it has not been authorized, sponsored, or otherwise approved by Early Warning Services, LLC. Zelle is a trademark of Early Warning Services, LLC.