Like all digital tools and resources, Venmo has its advantages as well as its risks. If you regularly use cash transfer apps for personal or business use, it’s best to know all about them to keep your information — and your money — safe. Use this guide to learn more about Venmo, how it works, and the safety concerns you should keep in mind.

Is Venmo trustworthy?

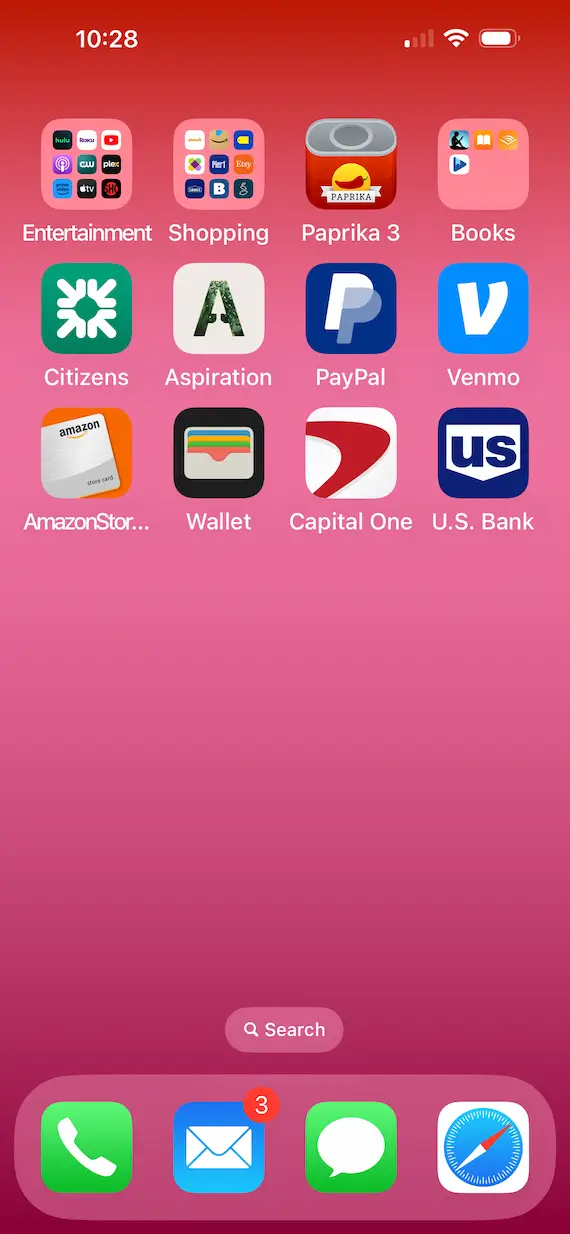

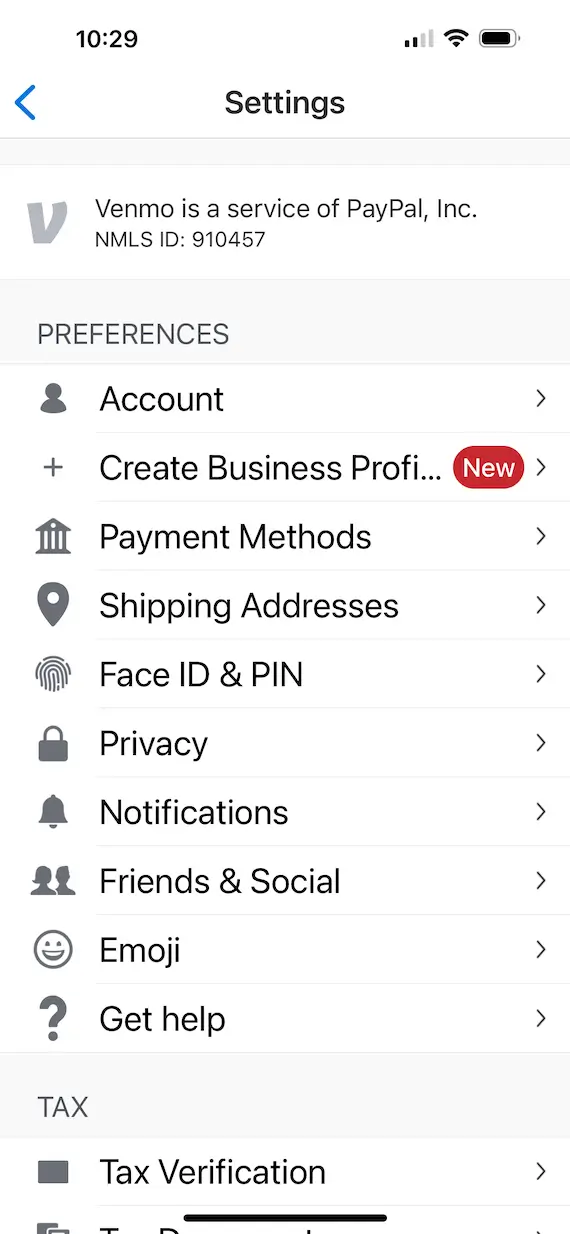

Venmo began as a peer-to-peer payment app, which is why its security is often questioned. It was acquired by PayPal in 2013. Since then, the payment service has grown into a certified, reputable cash app with millions of users.

People often question whether Venmo is safe to connect to your bank account and whether it is safe to give Venmo your SSN. These concerns seemed to be vindicated after some unfortunate data breaches and vulnerabilities. Venmo was subsequently forced to beef up its security and privacy protection for its users.

Is it safe to connect a bank account to Venmo?

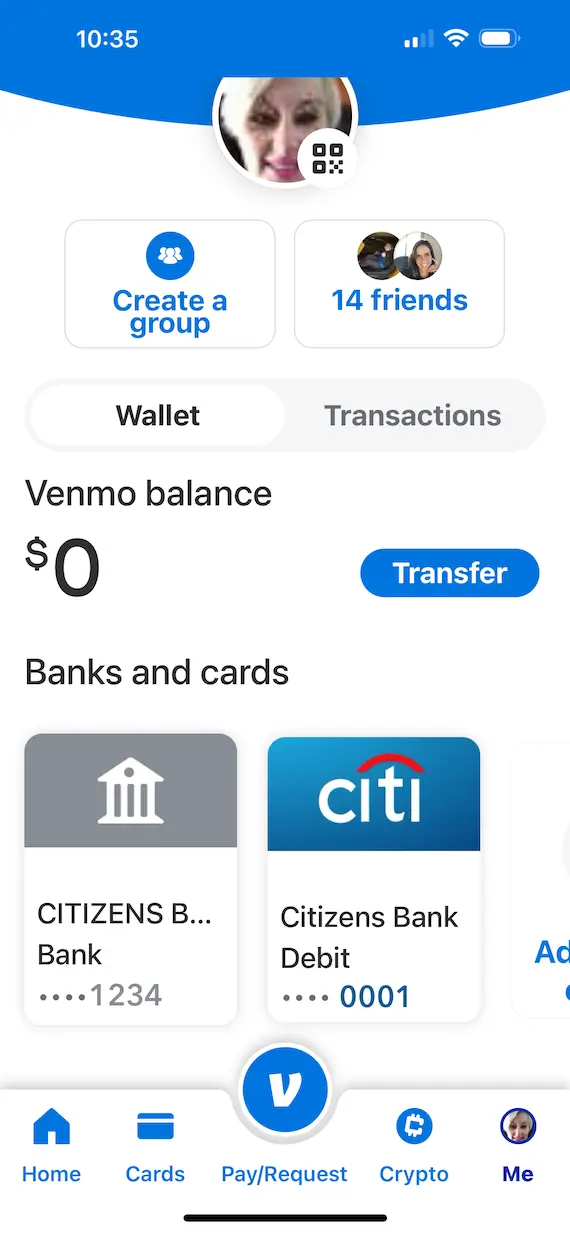

The short answer is yes. It is safe to connect your bank account to Venmo. The company uses bank-grade encryption, optional two-factor authentication, and mandatory email and phone number verification. The service also includes safeguards against connecting with unknown users or sending them money. Venmo also has purchase protection if you buy goods or services using Venmo. Be sure to read the legal terms before linking your bank account.

Is it safe to give Venmo the last 4 digits of your SSN?

The United States Treasury Department regulates Venmo and similar apps. Any cash transfer service must comply with the Federal Deposit Insurance Act (FDI) in line with money transfers. This is why Venmo and other services request your social security number or a portion of it.

To be safe, only enter your SSN directly in the app. If someone contacts you claiming to be from Venmo and requests it via phone, text, or email, do not give it to them. This is how identity thieves get your private information.

Protect your Venmo login from hackers

Is Venmo safe from a cybersecurity perspective?

Is Venmo safe to use? Well, that depends on how you use it.

From a cybersecurity standpoint, many things are safe if you use them carefully and take proper precautions. Most data breaches stem from user error or ignorance of cybersecurity best practices. If you follow the suggested cybersecurity guidelines, you can feel safer using any digital cash transfer app.

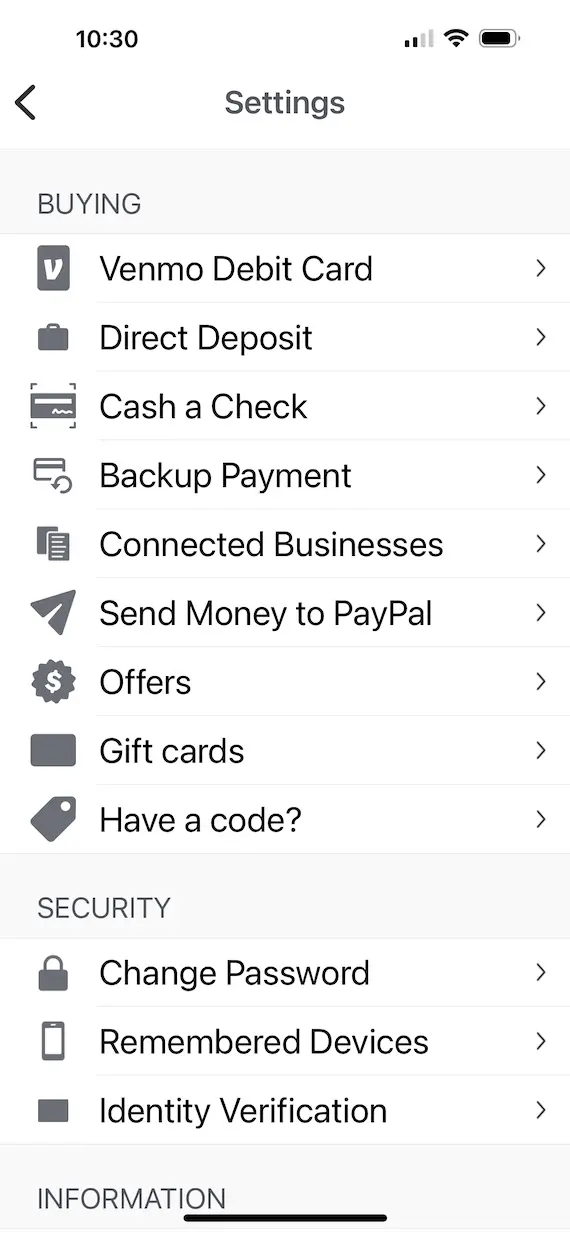

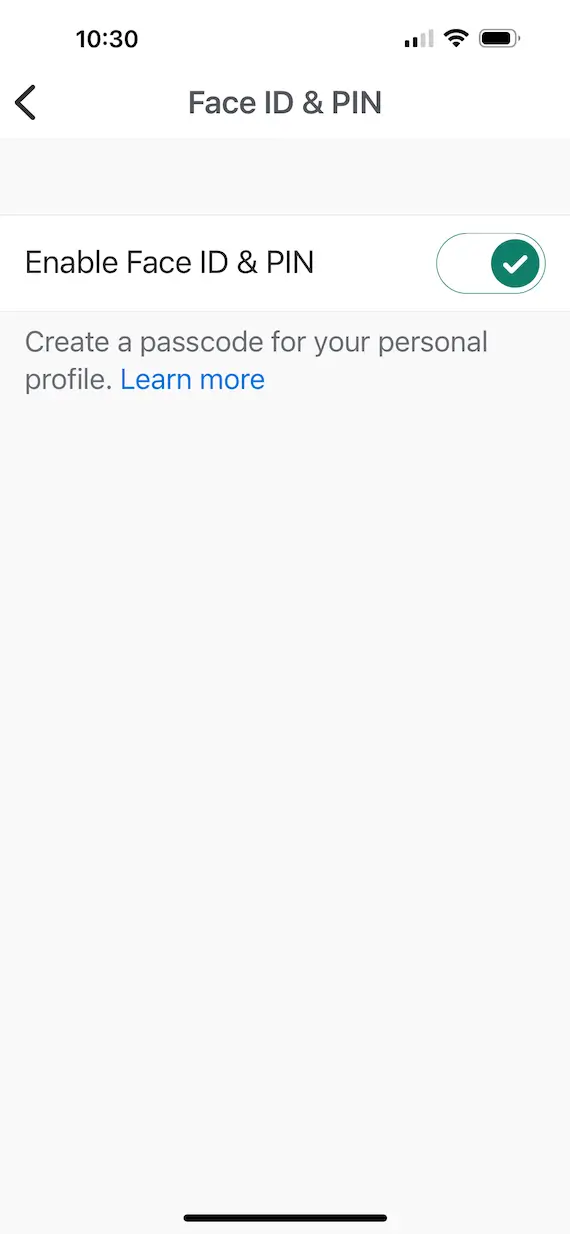

Venmo includes security features like allowing you to log out if you lose your phone or it is stolen. You can also secure your Venmo app with a personal identification number (PIN) so no one but you can access it.

Can hackers steal money from your Venmo?

Hackers can pretty much gain access to anything if they are skilled enough. However, you can make their job much more challenging by keeping your account safe and not sharing personal information. Venmo uses banking-grade encryption to secure your account, but if you aren’t careful, you could accidentally provide a hacker with what they need to gain access to your funds.

Can someone get your bank info from Venmo?

If someone gains access to your login credentials, they can use your Venmo account and drain your funds. Thankfully, the app does not show your entire bank account number but only the last four digits. Hacking into your Venmo account isn’t enough for someone to access your bank account, only the funds that are available within Venmo. Remember, Venmo deposits are not protected by the Federal Deposit Insurance Corp (FDIC), so if you lose money in Venmo, you won’t have any recourse to get it back.

How to stay safe when using Venmo

After all these warnings, you might be wondering how to keep your Venmo account safe. Fortunately, you can do a lot to keep yourself and your money protected. Follow the tips below to safely use Venmo and ensure that your account and money are protected.

1. Never store large amounts of cash in Venmo

Never keep a large balance in Venmo, just in case someone hacks the service or gains access to your account. Transfer any money you receive out of the app quickly.

2. Only transfer money to known contacts

Use Venmo to transfer money to friends, family, and business professionals you know well. Do not ever transfer money to a stranger for any reason. You may never see it again and may not get what you are paying for.

3. Never share personal information online

Don’t share your personal details online. Carefully protect all your account passwords and bank account numbers, as well as your social security number and any other personal information that would allow someone to gain access to your funds.

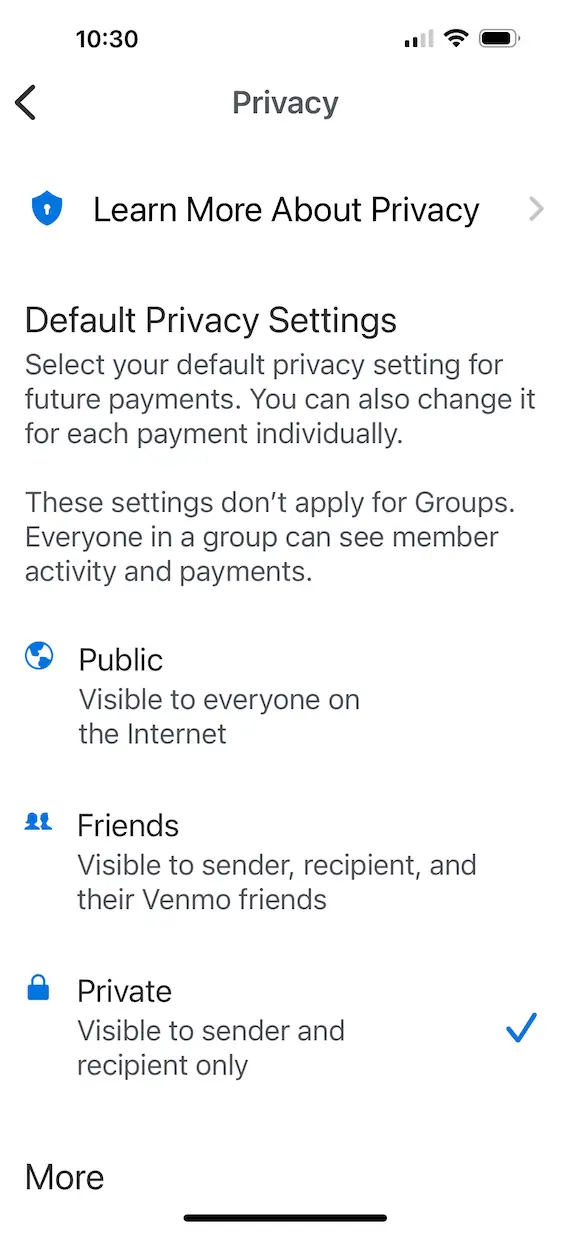

4. Set your account to Private

Set your Venmo account to “Private” to ensure your transactions are not displayed to the world in the feed and your profile.

5. Set up a Venmo-only bank account

For added security, set up a bank account and keep only a little money in it (less than $5). Use this bank account to link to Venmo. That way, your other main accounts won’t be affected if anything does go wrong. Transfer money into the account before using Venmo, and if someone pays you through the app, transfer it out quickly.

6. Link to a credit card

For even more protection, link your Venmo account to a credit card rather than a bank account. You will have greater control over chargebacks if you link a credit card. However, you will be charged a 3% fee when using a credit card through Venmo. Bank account transfers are free.

7. Keep a close eye on things

Keep a close eye on your Venmo account, and always check your bank statements for any unexpected charges. Never accept payments from an unknown sender; it could be a scam.

8. Never click links

Do not click on links in emails or text messages. Instead, use your browser to visit the website from there. Links may take you to fake or malicious websites.

9. Secure your phone

Since banking and Venmo apps live on your phone, secure them with Face ID, PIN codes, and biometric security. Never let anyone borrow your phone or leave it unlocked and unattended.

10. Don’t send goods until payment clears

If you sell something and receive payment through Venmo, wait until the payment clears before sending out the goods. Only use your business account, which includes built-in security features for vendors selling items.

So, is Venmo secure? Hopefully, we have been able to allay your fears and supply you with plenty of cybersecurity tips to keep your Venmo account safe and your money secure. The bottom line is to always err on the side of caution. If anything ever feels “off,” do not proceed.

This is an independent publication, and it has not been authorized, sponsored, or otherwise approved by PayPal Holdings, Inc. Venmo is a trademark of PayPal Holdings, Inc.