Identify theft is when someone uses your personal information to pretend they’re you and do things in your name, such as take out loans and commit fraud. Unfortunately, identity theft can happen to anyone. It can, however, be resolved if you act quickly. So, how should you respond to the theft of your identity? Read on to find out.

Because it can seem to happen as if out of the blue, getting to the bottom of what happened is a valid response when identity theft occurs. And if you’ve had your identity stolen, knowing what went wrong can help you prevent further incidents.

What causes identity theft?

Identity theft is caused by the theft of your personal identifying information. An identity thief accesses enough of your key identifying info, such as your social security number, address history, and banking information, to be able to trick others into thinking they’re you.

Cross one worry off your mind

Common causes of identity theft

The following are some of the most common causes of identity theft:

- Social media scanning: If you’ve shared a lot of personal information on social media, identity thieves might be able to get all the info they need from it. They might be able to do so even if your account is private by pretending to be someone else and connecting with you.

- Data breaches: Unfortunately, other people or organizations are sometimes responsible for your information being leaked. A company that you have an account with could become compromised and leak some of your key info.

- Phishing: Identity thieves might try to get you to give away your information by pretending to be a trusted person, organization, or institution. Usually, this means getting you to go to a website that you think is official (say, your bank). In reality, the site is transmitting everything you type back to the attacker. Attackers might also try to trick you into divulging personal info over text (“smishing”) or phone (“vishing“)

- Physical theft and dumpster diving: Although old-fashioned, physical theft and dumpster diving are still threats today. Identity thieves might try to access your personal information by looking through your trash or belongings.

- Social engineering cons: Identity theft can sometimes take the form of a straightforward con, i.e., social engineering. Often, identity thieves will prey on vulnerable people who might not understand the risks of the information they’re divulging, such as young people or elderly people.

- Friends or relatives: Unfortunately, those closest to us can sometimes be responsible for identity theft. A parent, for example, might open a credit card and rack up debt in their child’s name.

- Hacking your device: Although rarer than phishing, scamming, and physical theft, identity thieves can use hacking techniques to get your information. For instance, they might gain unauthorized access to one of your devices. They can then install malware that sends all the information you enter back to them.

How to know if your identity has been stolen

The first signs of identity theft can be difficult to spot if you don’t know what to look for. Here are some of the most common signs that your identity has been stolen.

Credit accounts you didn’t open

If you check your credit report and spot credit accounts you don’t remember opening, someone else could have used your information to open them. This is one of the most common ways an attacker will commit identity fraud.

Unknown items on bank or credit card statements

If you check your bank statement or credit card statement and notice unfamiliar bills or purchases, someone might have used your banking or card information to set up the payments.

Lost identity documents

If you can’t find a crucial identity document — passport, social security card, driver’s license, etc. — you should be wary of identity theft. The document might have been stolen rather than simply lost. Even if you did just lose it, someone with bad intentions could find it.

Redirected mail

If you’re expecting important mail from an official source, such as your bank, and it never arrives, someone might have stolen your identity and redirected your mail to them. Mail theft can sometimes lead to further identity theft because the thief will have access to even more of your identifying information.

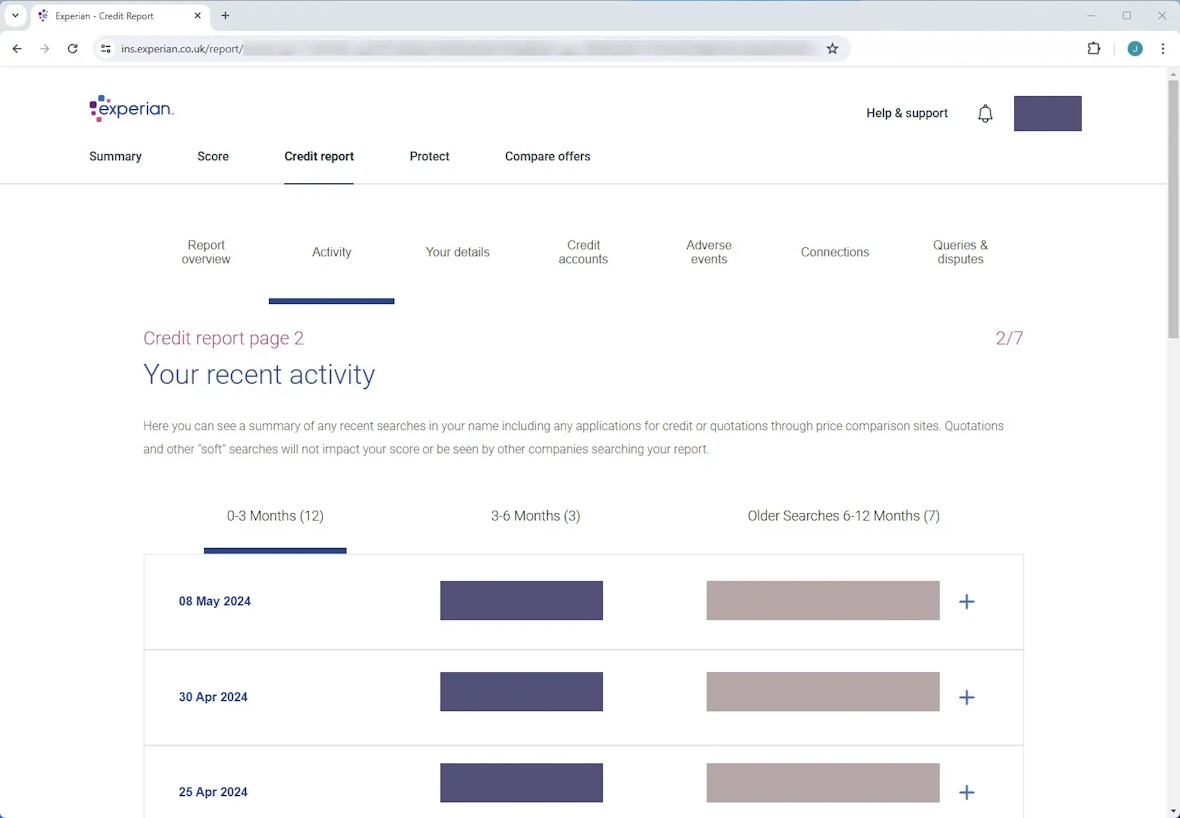

Credit report inquiries

If you notice credit inquiries on your credit reports, this could be a sign that someone is stealing your identity. While soft inquiries usually aren’t anything to worry about, hard inquiries often occur as part of a loan or credit application, which might suggest that someone’s using your information to try to open a line of credit in your name.

Debt collection

If you’re contacted by a debt collection agency about outstanding debts, someone could have stolen your identity and racked up debt in your name. Before you panic, ensure that the emails, calls, or texts are coming from a legitimate source. They could be from someone pretending to be a debt collection agency trying to get you to give away your personal information.

Denied loans or credit

If you’re unexpectedly denied credit or loans, this could be a sign that someone has stolen your identity and has taken out credit in your name. If debt has been piling up against your name, credit and loan companies won’t lend you more.

What to do if your identity is stolen

Speed is crucial for an effective identity theft response: Act quickly to prevent any further damage. Here are some of the most important steps to take if your identity has been stolen.

1. Contact your bank

If you think you’re a victim of identity theft, the first thing you should do is contact your bank and get them to cancel or pause any pending transactions, just in case whoever stole your identity has set up payments in your name. You should also let them know you’ve had your identity stolen and follow their recommendations. They should set up a notice on your account to require stronger verifications for any new payments.

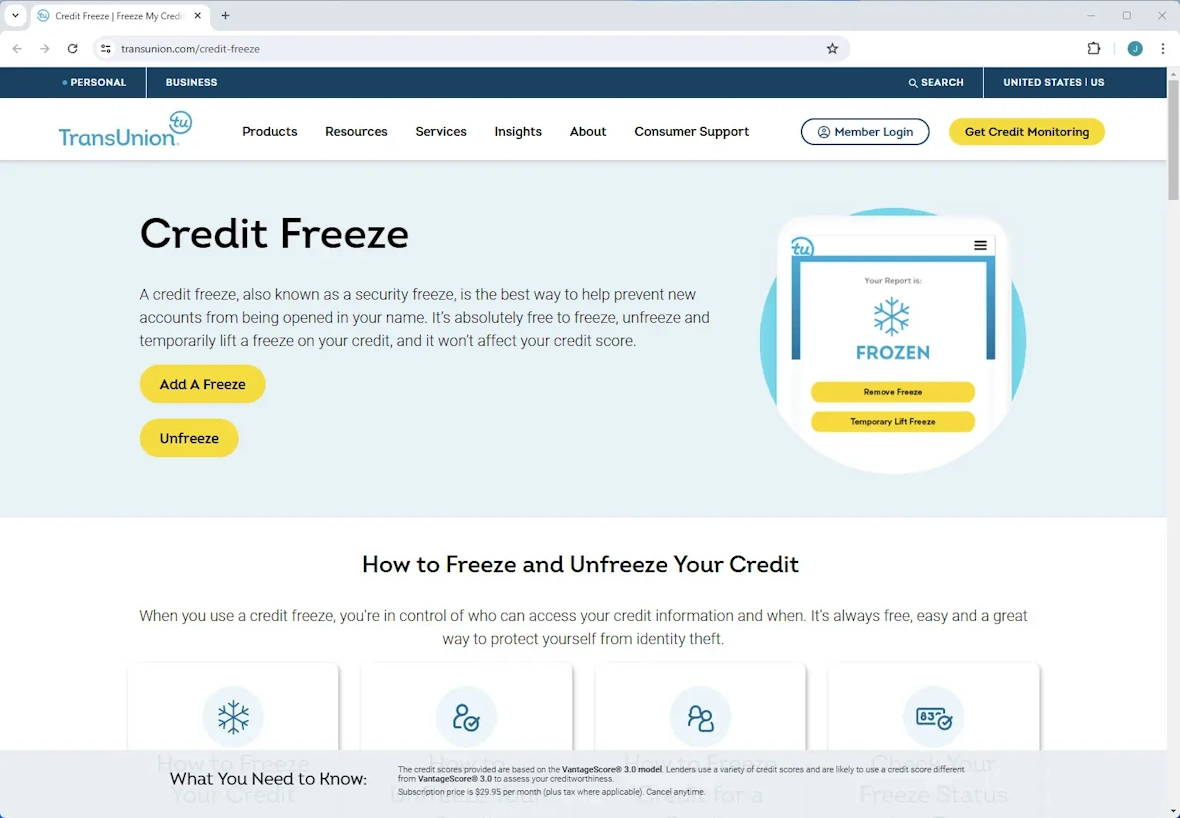

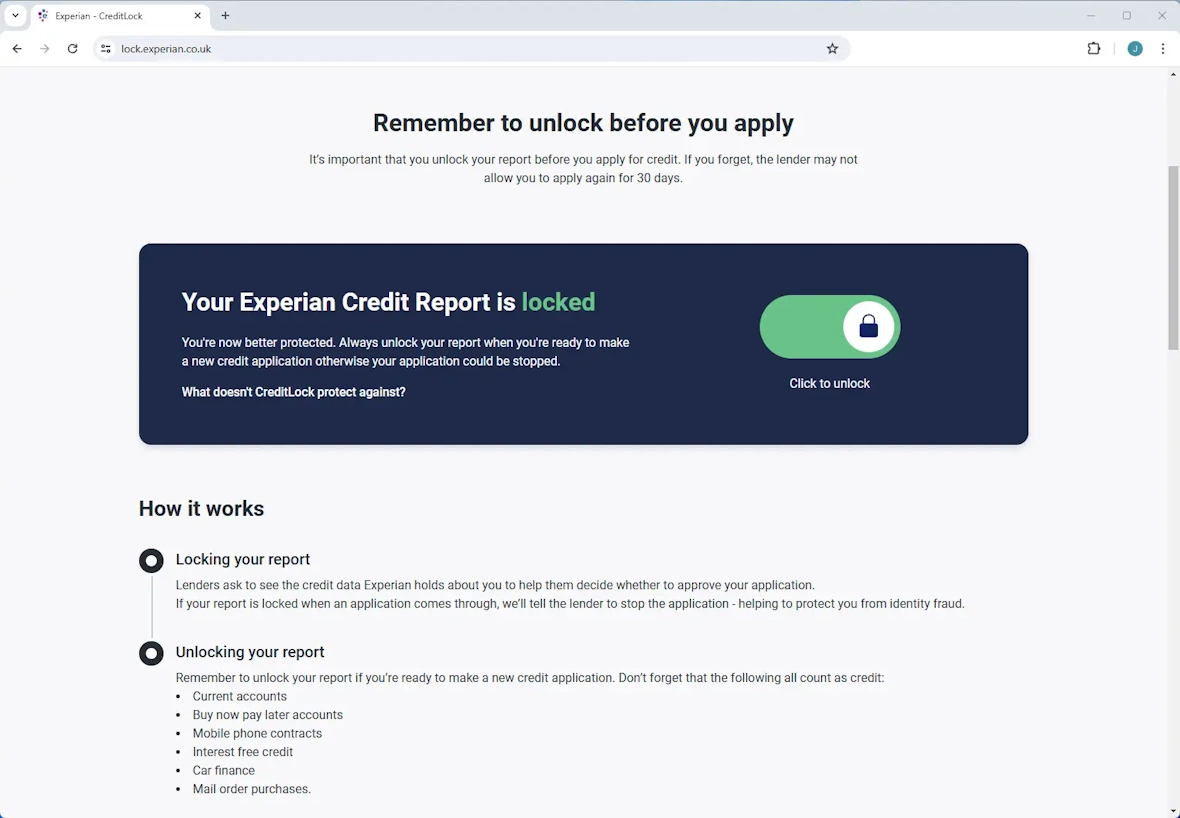

2. Freeze your credit

After contacting your bank, you should freeze or lock your credit. This means telling the three major credit bureaus — Experian, Equifax, and TransUnion — not to give out any of your information without your explicit permission.

Here’s where to go to file for a credit freeze at each of the three credit bureaus:

In practice, such a security freeze should mean an identity thief will find it harder to take out credit or loans in your name because credit and loan companies won’t be able to access your credit information. This should stop the identity thief from passing any credit checks when using your name and information.

3. Report it to the FTC and the police

After performing some initial triage with your bank and the credit report agencies, report the identity theft to the authorities in your country.

In the US, you should report it to the Federal Trade Commission (FTC) via their website or by calling 1-877-438-4338. You should also file a police report and remember to keep a copy of the crime reference number.

In the UK, you should report it to Action Fraud via their website or by calling 0300 123 2040. And, just like in the US, you should report it to the police.

4. Report any lost or stolen identity documents

If your identity theft involved any lost or stolen documents, such as a passport or social security card, report this to the organization or institution that issued the document. They should then put measures in place to prevent this document from being used for official purposes.

To report a lost or stolen passport:

- In the US, fill out a form via this government website.

- In the UK, report it on this government website.

5. Contact companies about affected accounts

If your identity has been stolen, you should contact all companies you have accounts with that might be affected so they can add additional identity verification requirements to your account actions. Some companies you might want to contact are:

- Banks and building societies

- Credit card companies

- Retail store accounts for which you can apply for credit

- Online retail sites such as Amazon

In other words, you should contact any companies with which you have accounts that can take payments or set up credit. And if you think other accounts (such as social media accounts) might be at risk, contact those, too.

6. Apply for protective registration (UK only)

In the UK, you can set up protective registration via Cifas, which costs £30 for two years. With this in place, any organization that uses Cifas will see a red flag against your name and know to perform additional identity verification checks before setting you up with their products or services.

Credit and data companies in other countries offer similar security options.

7. Change your login information

If someone’s stolen your identity, they might be able to take over your accounts. If you’re worried that an identity thief is already in your accounts, change your username, password, and maybe even your associated email for the accounts you’re most concerned about.

What are the consequences of identity theft?

Identity theft isn’t the end of the world if you react quickly, but if left unchecked — for example, if you don’t know about it — it can cause a lot of serious problems. Here are some of the most common consequences of identity theft and identity fraud.

Bad credit

Most identity thieves attempt to commit identity fraud by taking out loans or credit in the victim’s name. As such, after your identity has been stolen, you might notice a bad credit score and be unable to take out any more loans or get any more credit.

Drained bank balance

If an identity thief has managed to get their hands on your banking information, such as your card number and PIN, they might start taking money out of your account.

Debt collection

If you’re a victim of identity theft, debt collection agencies might start contacting you to try to collect debts accrued in your name. Identity thieves will often take out loans or credit in your name. Consequently, debt recovery agencies might start coming to you seeking repayment.

Account takeover

If you’ve had your identity stolen, over time, you might notice you can’t access various accounts, such as email or other online accounts. This could be because the identity thief has used your personal information to gain access to those accounts and changed your login information to keep you out.

Legal trouble

In some of the worst cases of identity theft, you could find yourself on the wrong end of the law due to something you didn’t do. For example, the identity thief might commit crimes such as fraud, which are then erroneously traced back to you.

How can you prevent identity theft?

The best thing to do about identity theft is to prevent it from happening in the first place. While nobody can make themselves completely immune to the efforts of a diligent identity thief, there are plenty of things you can do to make it less likely that you’ll have your identity stolen. Here are the best steps you can take to prevent identity theft.

Shred your documents

One of the most common ways identity thieves access your personal information is by finding it in your important documents, such as bank and utility statements. You can make it much less likely that they’ll be able to do so by ensuring that you shred documents before throwing them out.

Check your credit reports

Identity fraud can be caught before it’s too late, but to catch it, you have to pay attention to the right things. Credit reports from TransUnion, Experian, and Equifax should show you any new credit or loans taken out in your name. They will also show any changes made to your personal information, such as your address history. If you notice any discrepancies or things that shouldn’t be there, take action.

Keep important documents safe

Identity thieves can’t use what they don’t have. If they don’t have access to the personal information contained in your important documents, such as your passport and driver’s license, they can’t use it to steal your identity. Try to keep any documents containing important identifying information safe. Keep them either on your person or in a secure spot in your home.

Only visit trusted websites

Some identity thieves try to steal information by phishing for it. For example, a thief may try to trick you into giving information away on a fake website that seems official. To prevent this, ensure that all the links you click on are legitimate and all the sites you visit are official.

Limit the information you share online

Identity thieves can spend a lot of time combing through public-facing accounts. They use this data to piece together important information about victims and use it to steal their identities. If you don’t share much information about yourself online, they’ll have a harder time finding anything useful. For the best chance of preventing identity theft, keep what you share online to a minimum.

Ensure that mail is sent to the correct address

If you’re moving house, remember to inform all the contacts, organizations, and institutions who might send you mail. If mail is sent to your old address, whoever now lives there could open it and view your personal information, which they could then use to steal your identity.

You can also set up mail redirection with your country’s postal service:

- In the US, let USPS know.

- In the UK, let Royal Mail know.

Lock your credit accounts

Identity thieves will find it more difficult to take out credit in your name if your credit report accounts are locked. Locking is more convenient than freezing. Freezing your credit will take more time and effort to unfreeze. In fact, credit can be locked and unlocked with a simple button press on the relevant app or website.

You can lock your credit reports with all three of the major credit bureaus:

- Visit here to set up Equifax file locking.

- Visit here to set up TransUnion file locking.

- Visit here to set up Experian file locking.

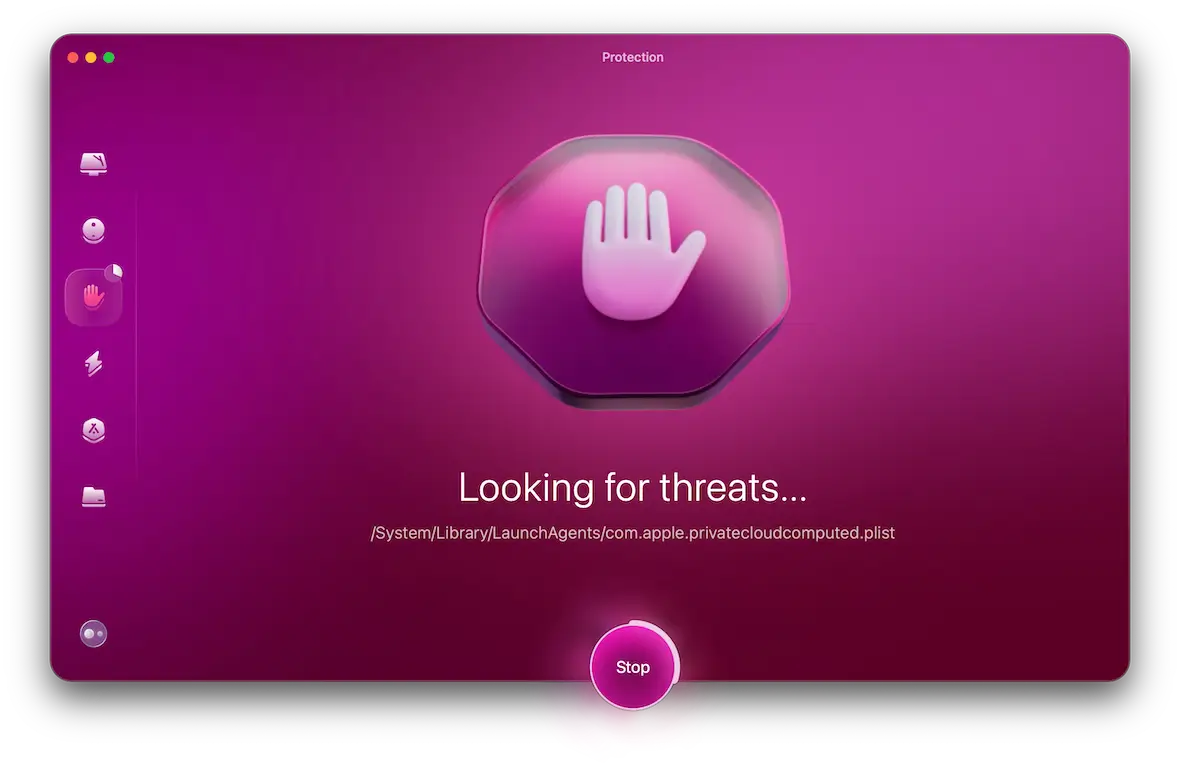

Keep your devices protected

If they can’t access your personal information by other means, identity thieves might try to steal it by hacking your device and infecting it with malware. As such, it’s important to keep your device protected and regularly scan it for malware. Using CleanMyMac is an easy way to do this. Its Protection tool powered by Moonlock Engine will keep an eye on your Mac and run a malware scan whenever you need one.

Having your identity stolen can be unnerving, especially when your information is used for financial identity fraud, but if you act quickly, you can resolve the problem before some of the worst consequences occur. Fortunately, there’s also a lot you can do to secure your information and prevent identity theft from happening in the future.